Tempted to buy cans? Don’t Catch a Falling Piano

Several people approached me over the weekend with questions about the banking sector. The questions revolved around one key point:

With financial institutions bailing out and bank stocks already down, does it make sense to buy banks now?

I told them to avoid this sector.

Just last week, some investors thought buying Credit Suisse (CS) at $2 was a low-risk offer. These people are now looking at losing about 50% in just a few days.

Despite the current situation, analyst RW Baird advised investors to buy US Bancorp (USB) shares. On Monday appearance on CNBC final callBaird analyst David George said the following:

“In my opinion, this is not a crisis. I just don’t believe Silicon Valley or Signature are really relevant comparisons. This is an incredible opportunity to become more aggressive on these stocks.”

I hope these words will no longer haunt Mr. George. I am, of course, much less optimistic about the current market situation in general and financial stocks in particular.

There is a saying in this business: “Don’t catch a falling knife.” That’s great advice, but in the case of US Bancorp, buyers risk catching a falling piano.

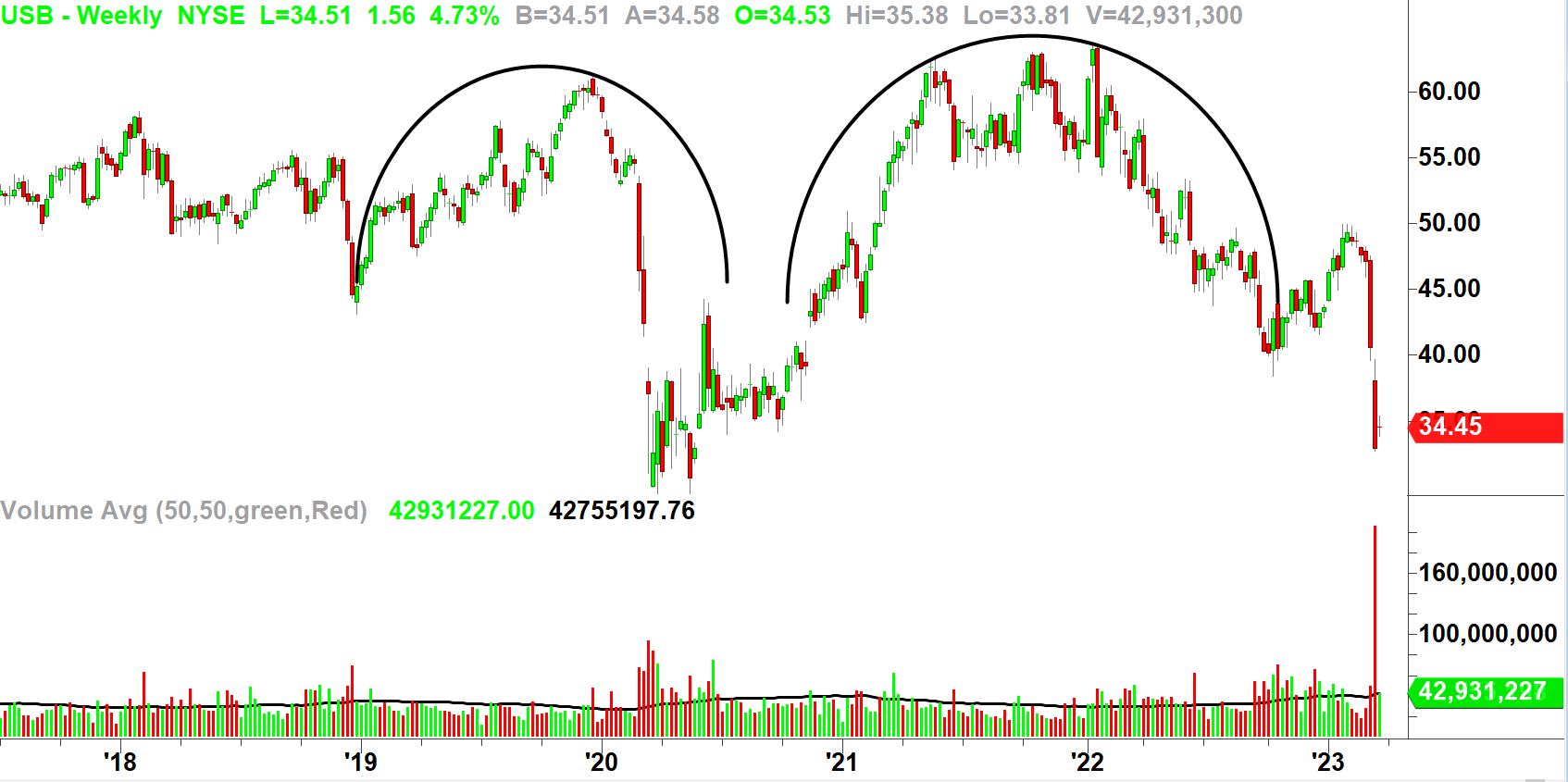

Chart Source: TradeStation

Institutions gladly dispose of these stocks. On Monday, the volume was about 4 times the 50-day average (point A). US Bancorp volume has been above normal every day since March 9th.

USB is well below its 50-day (blue) and 200-day (red) moving averages, which are poised to cross (point B). This is a sign of bearish momentum.

US Bancorp has a huge double top (curved lines) on the weekly chart. This massive bearish pattern formed over a four year period.

Chart Source: TradeStation

Why do investors feel the need to “fish the bottom”? We do this because everyone loves a good deal. Whether it’s a pair of shoes or a box of cereal, it’s nice to buy something for less than it’s worth.

The problem is, how can we determine the exact value of any single financial institution when there are potential systemic problems with the entire sector?

If RW Baird or any other investment firm thinks it’s safe to intervene, that’s just an opinion. Even if Mr. George’s assessment is correct, is the reward really worth the risk?

Until the extent of the damage is cleared up, there is no good reason to buy US Bancorp or any other names in the financial sector.

Get email notifications every time I write a real money article. Click “+ Subscribe” next to my signature for this article.

News Press Ohio – Latest News:

Columbus Local News || Cleveland Local News || Ohio State News || National News || Money and Economy News || Entertainment News || Tech News || Environment News